What is a Tax Return?

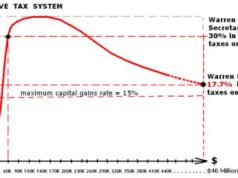

A Tax Returnis a legal process that exists within the setting of taxation. Individuals who have undergone a percentage of wages withheld with regard to earnings incurred as a result of employment. Individual Taxpayerswill be eligible to receive tax refunds subsequent to the annual income tax filing respective to the tax year. The determination of gauging a tax return may vary depending on type of business, occupation, dependents, income, household, and a variety of additional factors.

How to Determine the Value of a Tax Return?

Tax payments required by individuals that exist in tandem with financial, commercial, and consumer activity. Taxes may be incurred for a variety of reasons and through a variety of means; the accumulation of required tax payments – as well as the calculation of a tax return – may range in their collection process, procedure of payment, and respective rates. The following principles latent within taxation will typically affect the regulation of a tax return:

Tax Forms

Tax forms substantiate the wage earning incurred as a result of employment responsible for gauging applicable income tax, as well as serve to establish the amount of money due to an individual upon the receipt of their tax return; the following factors are considered with regard to the determination of a tax return:

A W-2 tax form assists in the regulation of the amount earnings withheld resulting from Social Security deductions

A dependent is an individual – or individuals – for whom the taxpayer claims responsibility on their respective W-4 income tax forms; the W-4 income tax form is required in order to regulate the amount of wages withheld subsequent to earnings; while individuals claiming a higher number of dependents will typically undergo a smaller amount of earned income withheld from each paycheck, individuals claiming zero dependents will typically experience larger tax refunds

Expenses latent within the facilitation of products and services utilized in order to provide maintenance and operations of a business may factor into the determination of an individual tax return

FEDERAL FORMS

FORM 1040, Individual Income Tax Return

FORM 1040A, Individual Income Tax Return

FORM 1040X, Amended U.S. Individual Income Tax Return

FORM 1040EZ, Income Tax Return for Single and Joint Filers with No Dependents

FORM 1041, Income Tax Return for Estates and Trusts

FORM 1041, Instructions

FORM 1041 ES, Estimated Income Tax for Estates and Trust

FORM 1065, Return of Partnership Income

FORM 1099, Miscellaneous Income

FORM W-2, Wage and Tax Statement

FORM 1120, Corporation Income Tax Return

FORM 1120, Instructions

FORM 1120S, S-Corporation Income Tax Return

FORM 4506-T, Request for Transcript of Tax Return

STATE INCOME REFUND FORMS

Alabama Forms (Indi 1. 2. 3. Corp 1. 2.)

Alaska Forms (Corporate 1.)

Arizona Forms (Indi 1. 2. Corp 1. 2.)

Arkansas Forms (Indi 1. 2. 3. 4. Corp 1. 2.)

California Forms (Indi 1. 2. 3. 4. Corp 1. 2. 3.)

Colorado Forms (Indi 1. Corp 1. 2.)

Connecticut Forms (Indi 1. 2. 3. 4. Corp 1. 2.)

Delaware Forms (Indi 1. 2. Corp 1. 2. 3.)

Florida Forms (Corporate 1. 2. 3.)

Georgia Forms (Indi 1. 2. 3. Corp 1. 2. 3.)

Hawaii Forms (Indi 1. 2. 3. Corp 1.)

Illinois Forms (Indi 1. 2. Corp 1. 2.)

Indiana Forms (Indi 1. Corp 1.)

Iowa Forms (Indi 1. Copr 1. 2.)

Kansas Forms (Indi 1. Corp 1.)

Kentucky Forms (Indi 1. 2. 3. 4. Corp 1. 2.)

Louisiana Forms (Indi 1. 2. 3. Corp 1.)

Maryland Froms (Indi 1. 2. 3. Corp 1. 2.)

Massachusetts Forms (Indi 1. 2. Corp 1. 2. 3.)

Michigan Forms (Indi 1. 2. Corp 1. 2.)

Minnesota Forms (Indi 1. 2. 3. 4. Corp 1. 2. 3.)

Mississippi Forms (Indi 1. Corp 1.)

Missouri Forms (Indi 1. 2. Corp 1. 2.)

Montana Forms (Indi 1. 2. 3. 4. Corp 1. 2.)

Nebraska Forms (Indi 1. 2. Corp 1. 2.)

New Hampshire Forms (Indi 1. Corp 1. 2.)

New Jersey Forms (Indi 1. 2. Corp 1. 2.)

New Mexico Forms (Indi 1. 2. 3. Corp 1. 2.)

New York Forms (Indi 1. 2. Corp 1. 2. 3.)

North Carolina Forms (Indi 1. 2. Corp 1. 2.)

North Dakota Forms (Indi 1. Corp 1.)

Ohio Forms (Indi 1. 2. 3. Corp 1.)

Oklahoma Forms (Indi 1. 2. Corp 1.)

Oregon Forms (Indi 1. 2. 3. Corp 1. 2. 3.)

Pennsylvania Forms (Income Tax Return)

Rhode Island Forms (Indi 1. 2. Corp 1. 2.)

South Carolina Forms (Indi 1. 2. Corp 1. 2. Inst)

South Dakota Forms (Corp 1. 2.)

Tennessee Forms (Indi 1. Corp 1. 2.)

Utah Forms (Indi 1. Corp 1. 2.)

Vermont Forms (Indi 1. Corp 1. 2.)

Virginia Forms (Indi 1. 2. 3. 4. Corp. 1. 2. 3.)

Washington Forms (Seller, Buyer)

West Virginia Forms (Indi 1. 2. 3. 4. Corp 1.)

Wisconsin Forms (Indi 1. 2. 3. 4. Corp 1. 2. 3. 4. 5.)

Tax Return Services

Tax services can be utilized with regard to the provision of assistance to individuals interested in the investigation and substantiation of estimated tax refunds:

- A Certified Public Accountant (CPA) provides a financial analysis with regard to private tax preparation services; a CPA may provide assistance in the filing of taxes in order to render the maximum amount of money latent within a tax return

- Electronic filing – which is also known as ‘E-Filing’ is a method of tax filing that can be undertaken by an individual through the Internet. Traditionally fashioned with ‘text fields’ that require specific financial information on the part of the individual filing, subsequent to submitting an E-File, an individual will receive a projected approximation of a tax return.

- A Tax Calculator is a financial resource typically accessed through taxation resource websites existing online; these resources not only provide the estimation of applicable withholdings, but also individual tax returns expected.