Introduction

Filing taxes can often be a stressful and time-consuming process, especially if you are not aware of the various deductions and credits that you are eligible for. However, with the help of an income tax calculator, you can easily calculate your taxes and make the process much simpler.

What is an Income Tax Calculator?

An income tax calculator is an online tool that helps you calculate your taxes based on the income and deductions you have entered. It takes into account your gross income, deductions, and credits to provide you with an accurate estimate of the amount you owe to the government.

Benefits of Using an Income Tax Calculator

There are numerous benefits of using an income tax calculator, including:

1. Saves Time: An income tax calculator automates the process of calculating your taxes, thereby saving you time and effort.

2. Accurate: These calculators use accurate formulas to calculate your taxes, ensuring that you are not underpaying or overpaying your taxes.

3. Convenient: An income tax calculator can be accessed from anywhere with an internet connection, making it a convenient option for people who lead busy lives.

4. Helps You Plan: By providing you with an estimate of your tax liability, an income tax calculator helps you plan your finances better.

How to Use an Income Tax Calculator

Using an income tax calculator is simple and straightforward. You need to provide certain information, such as your gross income, deductions, and credits. The calculator then uses this information to calculate your taxes.

Conclusion

Filing taxes can be an overwhelming task, but with the help of an income tax calculator, it can be made much simpler. It saves you time, provides an accurate estimate of your tax liability, and helps you plan your finances better. So, the next time you file your taxes, consider using an income tax calculator to make the process much easier.

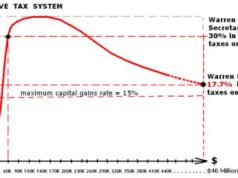

Income Tax Defined

Income Tax is legal process with regard to payment required from citizens of a country or nation resulting from wages incurred from employment. The determination of income tax payments, which is classified as ‘progressive’, results from the calculation of tax payments are factored upon the amount of income earned by that individual as a result of their respective employment.

In addition, Income Tax is classified as a direct tax, which means that the taxpayer will be required to submit tax payments directly to the Federal Government; this process is absent in the case of an indirect tax – indirect tax is typically processed through a third-party intermediary.

Furthermore, income tax refunds are disbursed directly from the Federal Government to the individual taxpayer upon the tax refund process. An Income Tax Calculator can be utilized in the event that an individual is interested in investigating projected income tax payments, as well as estimated tax refunds.

How Does an Income Tax Calculator Work?

An Income Tax Calculator is a financial resource typically accessed through online taxation resource websites. An Income Tax Calculator may provide an estimation of applicable withholdings, tax payments, and refunds with regard to the initial Income Tax payment filed by an individual, entity, or company.

Income Tax Calculators are fashioned in order to allow individuals to input corollary financial information within specified fields available for entry. Subsequent to the accurate entry of applicable financial information – reflecting earnings and wages – an estimation of applicable taxation may be rendered.

How to Use an Income Tax Calculator?

An Income Tax Calculator may be accessed by anyone; providing an estimation with regard to the analysis of individual taxation. Income Tax Calculators will allow individuals to input appropriate financial information into the following specified fields:

Identifying Dependents

A dependent is an individual – or individuals – for whom the taxpayer claims responsibility on their respective W-4 income tax forms; the W-4 income tax form is required in order to regulate the amount of wages withheld subsequent to earnings; while individuals claiming a higher number of dependents will typically undergo a smaller amount of earned income withheld from each paycheck, individuals claiming zero dependents will typically experience larger tax refunds.

Reporting Earned Income

An income tax calculator may require an individual to input a wide range of reports reflecting the earned income incurred by individual employment; this will typically include both a gross-earned income report, as well as a net-earned income report:

Gross Income is the amount of income earned by an individual prior to tax withholding

Net income is the amount of income earned subsequent to taxation withholding

Analyzing Deductions

Income Tax Calculators may prompt a user to input applicable products or services facilitated by an individual tax payer for which tax payments may be liable for tax relief; in many cases, the expenses latent within these products and services utilized with regard to maintenance of individual occupation may be result in tax deductions.

Income Tax Calculator Precautions

An Income Tax Calculator may not accurately factor specifications and exceptions that exist within specific and individual circumstances, withholdings, and refund policies. Furthermore, upon utilizing an Income Tax Calculator, individuals are encouraged to remain cognizant of the accuracy latent within their respective entries; misinformation or falsified data may skew the final results:

Income Tax Calculators provided – or sponsored – by specific tax preparation services to privately-offered Income Tax Calculators; individuals are encouraged to investigate – and substantiate – the accuracy of income tax calculators

All official tax calculations should only be obtained by an authorized Income Tax preparation service or Department of Taxation – those interested in utilizing Income Tax Calculators are encouraged patronize reputable services and websites providing specific, IRS-accredited tax resources